Jan 19, 2021 Dynamic Pricing Test: COVID Case Study

By Ryan Keintz

— Newton’s 3rd Law

I created PricePoint because of the decade of dysfunction I witnessed in the pricing realm of international moving services. There are many structural causes of that dysfunction, but a central pillar is the practice of contract pricing.

By contrast, dynamic pricing is a pillar of the PricePoint model. As COVID has sent shockwaves of price disruption through the industry, we’ve been closely observing marketplace response and measuring the data. Would the COVID crisis expose flaws of dynamic pricing or provide further proof of concept? Spoiler alert… it’s the latter.

Let’s first briefly outline the basics.

Contract vs. Dynamic Pricing

Contract pricing refers to the practice of RFP solicitation of vast spreadsheets of door-to-door shipment prices, to which the winning supplier must strictly adhere for a set number of years. The RFP pricing process is a massive admin burden for the client and bidding suppliers. Clients (or a costly hired auditor) must perform detailed audits of all invoices to maintain contract compliance. The audit function drastically slows supplier cash flow while the adversarial audit paperchase creates a substantial administrative burden, adding cost and distracting from service delivery.

.jpg?width=862&name=dynamic1%20(1).jpg) Contract Pricing… You’re entering a world of pain

Contract Pricing… You’re entering a world of pain

By contrast, dynamic pricing allows for market-competitive price security, but naturally fluctuates with market conditions, cost changes, foreign currency shifts, etc. PricePoint’s foundational belief is that dynamic pricing is a win/win for buyer and supplier.

Let’s examine that assertion through the lens of the COVID pandemic…

The air (freight) bubble

COVID’s immediate impact across the industry was a dramatic inflation of air freight cost. As travel restrictions grounded fleets of passenger planes, there was a correlated reduction of cargo capacity. Supply down = Price up.

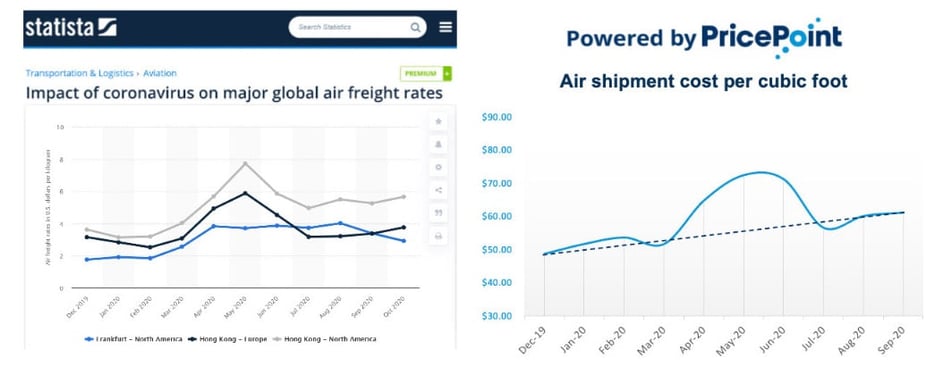

Charting the price impact on the global air freight market, as well as within the PricePoint market, note the striking similarity of the following graphs. On the left is statista’s study of air-cargo prices, while the right is PricePoint data of approximately 150 corporate clients’ spends.

Observable in both:

- Q2 spike for first three months of COVID response

- Q3 normalization of price slightly above pre-COVID levels

The takeaway is that the PricePoint marketplace responded hand-in-glove to real-time market conditions. Suppliers were allowed to charge fair but market-competitive prices. This is enabled by price transparency which handles 3rd party freight as a pass-through cost, separate from the supplier’s forwarding fees and margin which are insulated from 3rd party cost increases (movers, you can applaud here).

“But the client is paying more, which is bad for them, right?”

No, because you get what you pay for. Price down = Quality down.

When contract pricing forces the mover to absorb cost increases (effectively a forced discount), the mover is forced to explore lower cost options in transportation, materials, and labor. In order to avoid losses, the mover is also compelled to play invoicing games which the industry is unfairly notorious for. As per Newton’s 3rd Law, the admin distractions and cost externalities of contract pricing inevitably impact quality.

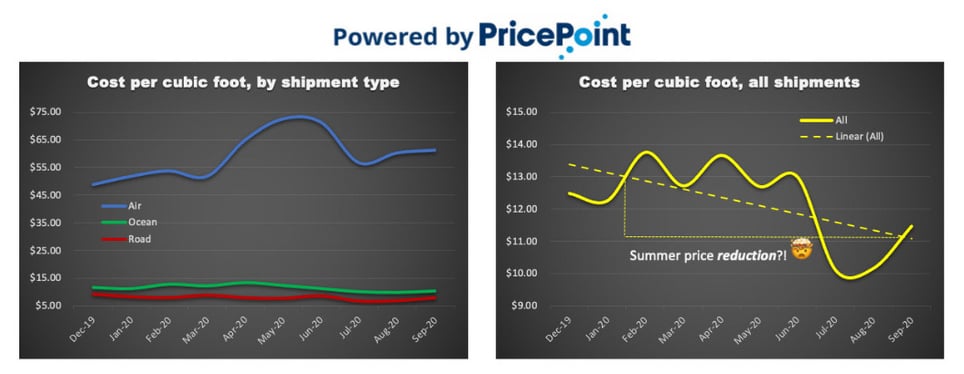

The full spectrum

Let’s zoom out for a couple more insights. Comparing air shipments side-by-side with ocean/road shipments shows us much more price stability in the latter. From Q1 to Q3, the cost of road shipments was substantially reduced, while the overall cost of all shipments saw a net cost reduction. That’s right, prices were overall lower in summer than winter.

“So the mover is charging less, which is bad for them right?”

No, this is good market efficiency.

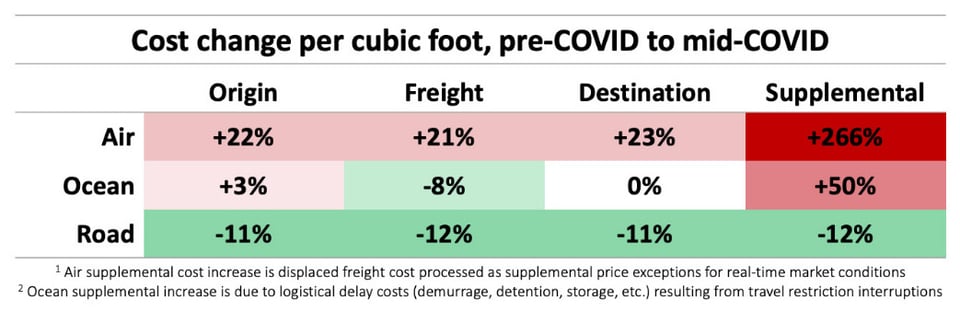

See the following matrix which zooms in to illustrate the component-level fluctuation.

For surface shipments, origin/destination service prices remained stable or declined. Why? In part because those services are labor intensive, and there has been a strong incentive for moving companies to keep their employees… well, employed. Likewise, there was a substantial drop in road freight prices because moving companies want to keep their moving trucks… well, moving. Using assets to generate revenue – even at a discount – is better than assets sitting idle.

International moving demand has been drastically reduced or delayed by COVID travel restrictions, so whereas Q3 is usually peak pricing for peak season (northern hemisphere summer), 2020 turned the norm on its head. Instead of the usual Q3 demand exceeding supply (price up), summer 2020 supply exceeded demand (price down). #DynamicPricing

We have witnessed simultaneous multi-directional shifts in supply-demand at the component cost level, translated to real-time shifts in PricePoint tariffs.

PricePoint enables this market fluidity by:

- Capturing pricing at the component level rather than exponentially more inefficient door-to-door bundled pricing (the default mode for contract pricing); and

- Allowing corporate-booking movers to link directly to live pricing from their global network of agents and freight providers via PricePoint (so that price changes at the wholesale level are translated to real-time retail price)

In essence we allow the free marketplace, properly moderated, to set fair prices rather than the traditional tedious analogue negotiation between the mover and the client/auditor. The client can rely on fair market-competitive pricing. The supplier can rely on fair and stable profit margins, focusing their attention on service delivery rather than jumping through admin hoops and profit-protecting invoice games.

So yeah, dynamic pricing is better.

Would you like to learn more?

Founder and President. After a career pricing for the largest international movers, Ryan observed that price manipulation was a more critical success factor than customer service or logistical expertise. He created PricePoint to fix a broken system.